The Catalyst

Late January 2026 brought an unexpected inflection point. Anthropic quietly published a collection of AI plugins for Claude Co-work, including a compact legal analysis module—roughly 200 lines of structured text. This module performed contract triage, identified irregular terms, and produced regulatory summaries with minimal human oversight.

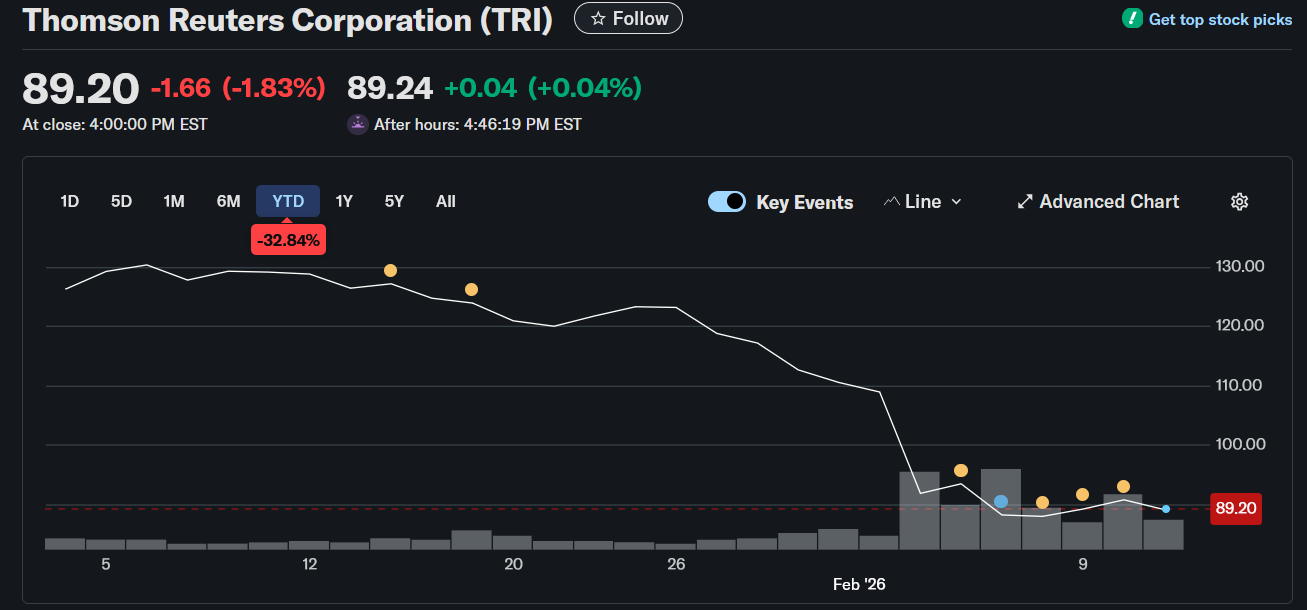

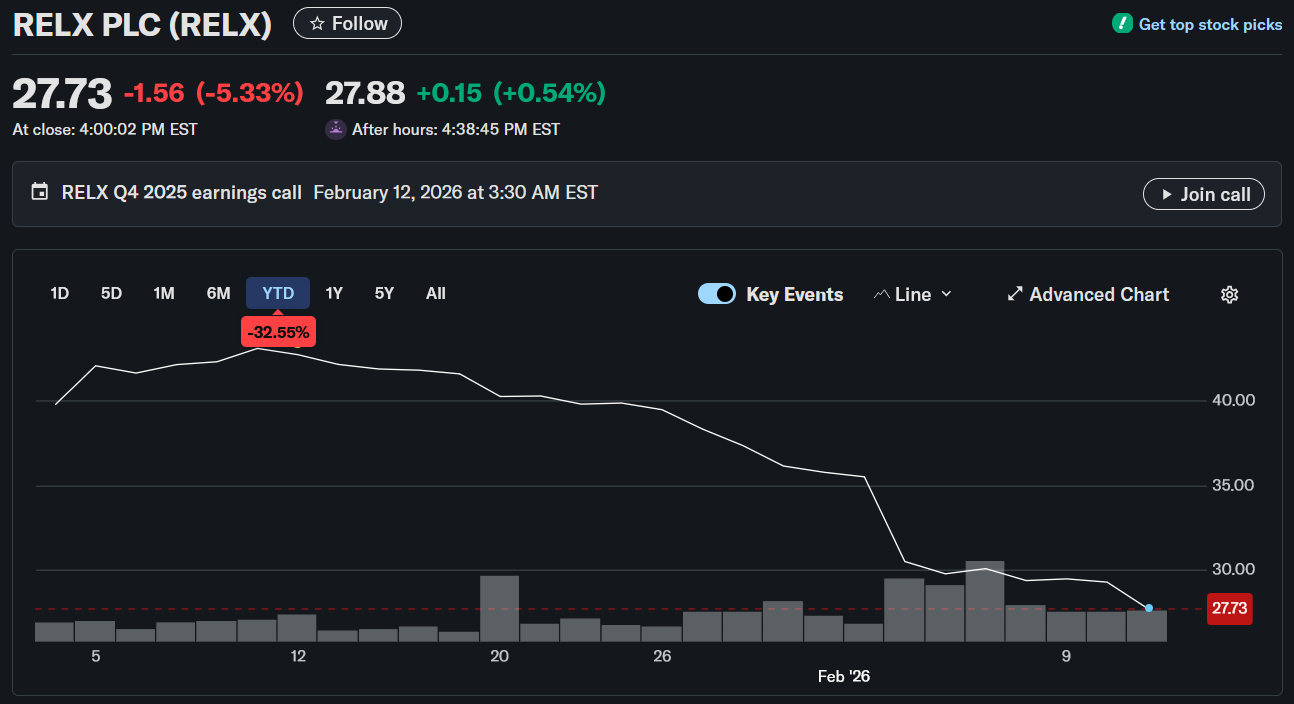

The market's response was swift and brutal. Over the next two trading days, legal tech and enterprise software stocks shed $285 billion in combined market value. Thompson Reuters declined 16%, RELX (LexisNexis' parent) lost 14%, and LegalZoom plummeted 20%. The panic rippled through adjacent sectors—private equity firms managing legal infrastructure portfolios saw sharp declines: Ares Management, KKR, and TPG each dropped roughly 10%.

This wasn't about a single file. It was about traders realizing the cracks had already formed months earlier.

An Unprecedented Repricing

The velocity and magnitude of this valuation shift marked an anomaly. Outside traditional crisis environments, software sectors rarely experience such concentrated revaluations. Yet here, within 48 hours, entire business model assumptions underlying knowledge-work platforms were fundamentally questioned by equity markets.

48-hour stock price movements following the January 30th, 2026 Claude Co-work plugin release

Text Files as Infrastructure

To understand the market's reaction, we must first grasp why plain-text instruction files have emerged as powerful economic tools. Anthropic's legal module represents one instance of a much larger phenomenon.

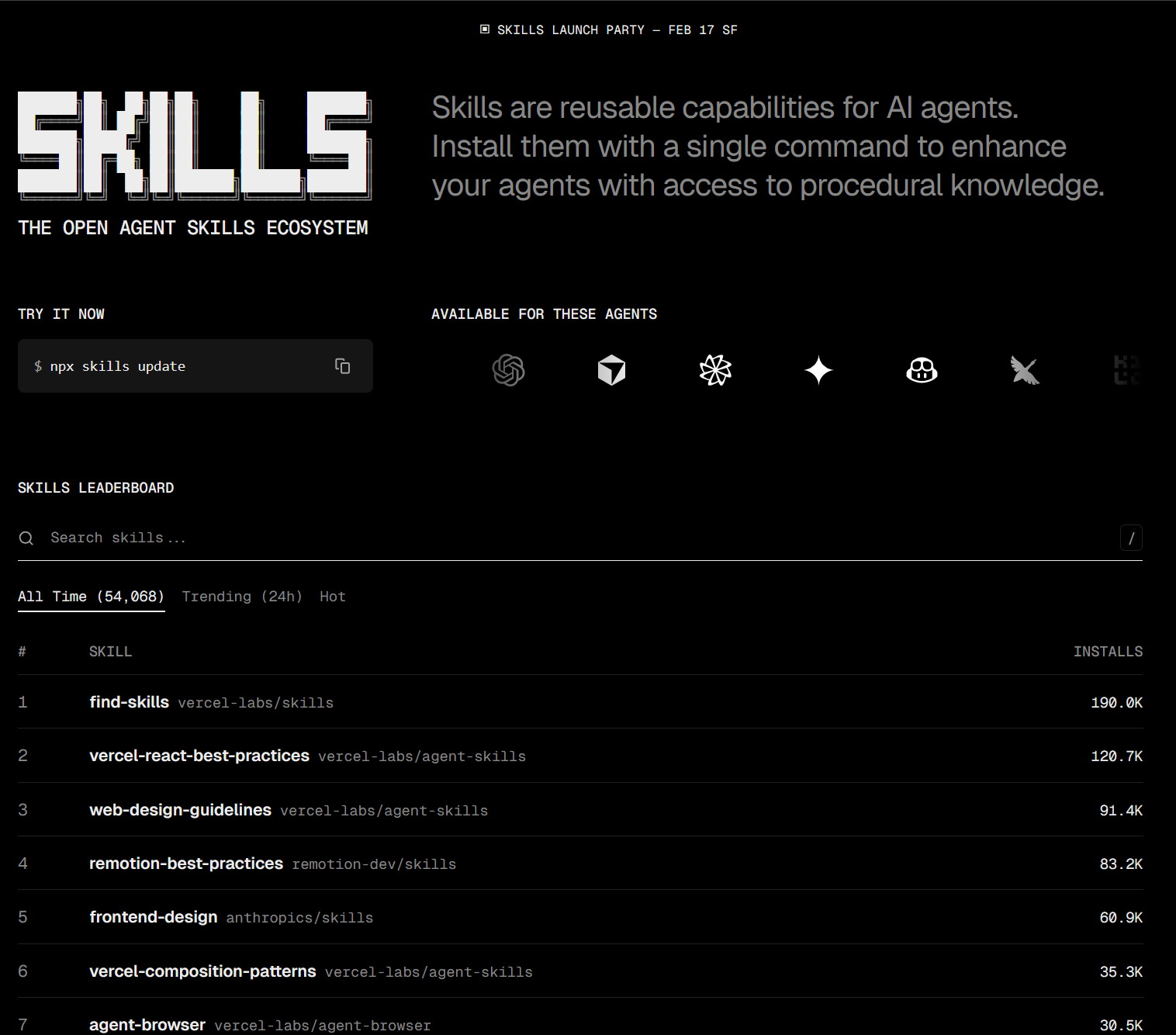

Consider Claude Code's architecture: it extends functionality through skill modules—structured text files defining specialized behaviors. Platforms like skills.sh catalog hundreds of these configurations spanning diverse domains—UI/UX design, code auditing, technical documentation, testing pipelines, deployment orchestration.

Most skills consist of 100-300 lines of formatted text. No compilation required. No dependency chains. Simply human-legible instructions that AI systems interpret and execute. Installation takes seconds, yet immediately amplifies a developer's capabilities within that specific domain.

The transformative element isn't the text format itself—it's that sophisticated workflows can be captured in plain language that both humans and machines interpret fluently.

When legal-tech leadership observed Anthropic's contract module, the implications extended far beyond direct competition. They recognized a pattern emerging across knowledge industries: structured text configurations enabling AI systems to reproduce expert-level workflows at marginal cost.

If text files from skills.sh allow junior engineers to match senior-level output in targeted domains, and if Anthropic's module replicates paralegal analysis, then every knowledge sector built on hourly billing confronts identical structural risks.

The Real Fracture Point

Per-seat licensing—the revenue foundation supporting enterprise software for two decades—had shown stress fractures well before January. Software sector forward P/E multiples compressed from 38x to 25x across four months, representing the sharpest valuation contraction outside the 2002 technology crash.

Defending the Wrong Territory

At the Cisco AI Summit, Jensen Huang articulated a common defense: "AI doesn't eliminate software—it operates through it. Greater AI deployment necessitates expanded software infrastructure."

This argument is technically sound yet strategically misaligned. The debate isn't whether organizations need software. The question is whether they'll continue paying for it through traditional seat-based models.

Consider the economics: when a single AI agent handles research previously requiring ten credentialed paralegals, each with separate Westlaw access, Thompson Reuters retains its data asset value—but surrenders nine license seats. The underlying information grows more valuable; the access monetization framework becomes untenable.

The Adoption Paradox: Markets Move Faster Than People

While markets repriced $285 billion in 48 hours, actual organizational transformation will unfold across years, not days. This creates a peculiar dynamic: equity markets pricing in disruption that most enterprises have yet to meaningfully experience.

Diffusion of Innovation in Practice

Everett Rogers' diffusion of innovation framework—validated across countless technology transitions—suggests AI adoption will follow the familiar S-curve pattern. Innovators and early adopters comprise perhaps 15% of organizations. The early majority takes years to mobilize. Laggards may resist until forced by competitive pressure or regulatory change.

Current evidence supports slow institutional adoption. A December 2025 McKinsey survey found that while 78% of enterprises acknowledge AI's transformative potential, only 11% have deployed production AI systems affecting core business operations. The gap between awareness and implementation remains vast.

Several factors explain this inertia:

- Integration complexity: Most enterprises operate fragmented technology stacks built over decades. AI insertion requires architectural overhauls, not simple plug-ins.

- Risk aversion: Legal, medical, financial, and regulatory sectors carry enormous liability exposure. Moving from human-verified to AI-augmented workflows requires clearing high trust thresholds.

- Organizational resistance: Knowledge workers understand AI threatens existing workflows. Internal pushback—both explicit and tacit—slows deployment even when leadership commits to transformation.

- Skills gaps: Effective AI deployment demands new technical and managerial capabilities most organizations lack. Hiring, training, and retaining AI-literate talent takes years.

The stock market doesn't wait for organizations to catch up. It prices the future into the present—often prematurely, sometimes correctly, always volatilely.

Random Shocks in a Structural Transition

This mismatch between market sentiment and operational reality creates conditions for repeated volatility spikes. As specific companies announce AI deployments reducing headcount, competitors' stocks may plummet on fears of falling behind. When integration projects fail spectacularly—and some will—the entire sector might rally on relief that transformation timelines stretch further than feared.

Expect recurring pattern: a law firm announces AI-driven 30% paralegal reduction → LegalZoom stock craters 15% → three months pass with minimal sector-wide change → stocks partially recover → another firm announces similar moves → cycle repeats. Each shock feels definitive. None are. The transition spans years, but markets react to each data point as if it's the final word.

Historical technology transitions show similar patterns. Cloud migration predictions in 2008 suggested enterprise IT would shift within 3-5 years. Reality took 12-15 years for majority adoption, with periodic market panics along the way as individual companies reported major shifts. AI follows this playbook—but compressed, accelerated, and with higher stakes.

Newspapers: A Cautionary Blueprint

Print journalism offers instructive precedent. The internet didn't render news content valueless—it demolished the distribution economics. Readers no longer needed to purchase entire newspapers for a single article. Advertisers no longer paid premium rates for captive audiences with limited alternatives.

The journalism survived. The bundled-product revenue model collapsed.

Enterprise software faces parallel dynamics. Core assets—proprietary datasets, refined workflows, accumulated institutional knowledge—retain genuine value. Thompson Reuters' legal precedent database required decades to assemble and cannot be replicated overnight. Salesforce's CRM relationship graphs are unique organizational assets. Adobe's creative toolchain maintains substantial network effects.

Yet seat-based licensing tied to these assets grows increasingly vulnerable as AI agents decouple access from headcount.

A Quiet Negotiation That Mattered More Than the Crash

While markets fixated on stock volatility, a less visible transaction illustrated the actual mechanism of change. KPMG renegotiated its audit contract with Grant Thornton UK, explicitly demanding fee reductions to reflect "efficiency gains from AI-augmented processes."

Grant Thornton's initial stance emphasized that "rigorous audits depend fundamentally on seasoned professional judgment"— an implicit argument against price cuts. KPMG's counter: adjust your pricing or we'll seek alternative providers.

The result: Grant Thornton's annual audit fees declined from $416,000 in 2024 to $357,000 in 2025—14% lower.

KPMG didn't deploy comprehensive audit automation. They weaponized the perception that AI made such automation possible.

This negotiation carries more weight than equity market gyrations. The $285B repricing reflected investor expectations. The KPMG-Grant Thornton contract represents actual commercial behavior—one enterprise extracting tangible price concessions from another by invoking AI capabilities, regardless of deployment status.

The cascade doesn't require universal AI implementation. It merely requires purchasing organizations to reference available capabilities and demand: "Technology has evolved. Your pricing should reflect that reality."

Market Incoherence as Signal

Bank of America's Vivek Arya labeled the sell-off "internally inconsistent"—an observation that inadvertently reveals deeper truths about how capital markets process structural uncertainty.

Institutional investors simultaneously embraced contradictory positions:

- Position A: AI infrastructure investment levels are economically unsustainable; capital expenditure cycles will inevitably contract

- Position B: AI deployment will prove sufficiently transformative to obsolete incumbent software business models

These positions cannot coexist logically. If AI capabilities justify a $285B software sector repricing, then underlying compute infrastructure requirements exceed current buildout rates, not vice versa.

Yet both trades generated returns during different market windows. Financial markets don't resolve contradictions— they exploit them through tactical rotation. The incoherence itself becomes the dominant narrative.

What Died vs. What Survived

What Survived

- Data systems: Proprietary databases, structured information, decades of accumulated enterprise knowledge

- Accountability layer: The vendor relationship, SLAs, legal liability, support teams that show up when systems break

What Died

- Per-seat pricing: The idea that revenue scales linearly with human headcount

- UI-first architecture: One-size-fits-all interfaces that humans navigate

- Human-as-bottleneck assumption: The foundational premise that humans must touch every workflow

Survival Pathways for Incumbents

Companies navigating this transition must shift from human-interface-centric to agent-navigable architectures— systems monetizing data value and accountability guarantees rather than user headcount.

This transcends incremental updates. It demands concurrent transformation across:

- Technical architecture (API-first, agent-accessible data layers)

- Revenue models (usage-based, outcome-tied, data-access pricing)

- Commercial strategy (enterprise partnerships, integration ecosystems)

This reconstruction unfolds while equity valuations decline and competitive pressure intensifies.

The Engineering Resource Dilemma

Beyond pricing challenges, software companies confront resource allocation crises: top engineering talent maintains legacy infrastructure precisely when next-generation agent-native replacements demand attention.

Each engineer supporting traditional human-facing interfaces represents capacity unavailable for agent-optimized systems. Each development cycle extending one-size-fits-all products consumes resources better directed toward agent-first reimagination.

Successful transitions require parallel execution—sustaining current revenue while building replacement architectures— within unchanged budget constraints.

The Economics of Near-Zero Development Costs

AI-driven software development fundamentally restructures economic assumptions:

- Cursor demonstrates systems producing 1,000+ code commits hourly without human authorship

- StrongDM releases internal standards explicitly stating "human-written code represents technical debt"

- Academic researchers document complete workflow automation using $10,000 in API credits

- Claude Code combined with skills.sh modules reproduces specialized expertise across domains—interface design, quality assurance, continuous deployment, peer review

The skills.sh ecosystem demonstrates a critical pattern: expertise encoding costs decline as rapidly as development costs themselves. Domain specialists can distill workflows into text configurations. Any engineer installing that module immediately accesses that expertise. Marginal distribution costs for specialized knowledge approach zero.

As development costs trend toward zero, build-versus-buy calculations invert. Enterprise SaaS value propositions historically depended on software creation being prohibitively expensive and time-intensive.

When custom-built solutions cost less than generic per-seat licenses, why purchase one-size-fits-all tools?

The Requirement Translation Bottleneck

This transformation hinges on whether AI systems can convert ambiguous, unstated human requirements into functional software—rapidly, with sustainable maintenance profiles.

Consider a sales executive requesting "improved pipeline visibility." That statement captures perhaps 5% of the specification needed for useful implementation. The remaining 95% resides in unstated organizational conventions, edge case handling, contextual prioritization, and tacit process knowledge.

Experienced product managers invest weeks eliciting these hidden requirements. Whether AI agents can replicate this discovery process—not merely generating code, but comprehending underlying needs sufficiently to produce appropriate solutions—remains an open question with enormous economic implications.

This uncertainty gives incumbent SaaS providers temporal breathing room. Their proprietary data and accountability frameworks offer genuine advantages. However, that advantage only materializes if they pursue agent-native architectures rather than superficially grafting AI features onto legacy human-facing interfaces.

Personal Parallels: Individual Knowledge Workers Face Identical Dynamics

The forces reshaping enterprise SaaS economics apply equally to individual knowledge workers. The distinction between superficial AI augmentation and fundamental workflow reconstruction mirrors precisely what transpired in software markets.

Using ChatGPT for email proofreading—messages you'd otherwise write manually—represents surface-level augmentation. Employing Claude for document summarization—content you'd otherwise read fully—similarly avoids deeper transformation. Integrating Copilot into development environments while preserving unchanged workflows exemplifies cosmetic adoption.

These patterns mirror SaaS companies adding AI features to existing products while maintaining underlying architectures. You're applying decorative solutions to structural challenges.

Velocity Beyond Comprehension

The pace of capability releases defies traditional adaptation timelines. Opus 4.6 launched, followed by Codex twenty minutes later. That same week, OpenAI released Frontier—a secured enterprise agent deployment platform spanning complete organizational data ecosystems.

Query current AI models for effective utilization strategies, and responses reflect frameworks already six months obsolete. AI advancement velocity exceeds even AI's ability to track its own evolution.

The distance between "I use AI tools occasionally" and "I've fundamentally restructured workflows around AI capabilities" represents the individual-scale equivalent of the $285B market correction.

Per-seat SaaS monetization has fractured. The underlying data assets and accountability frameworks remain intact. Parallel logic governs individual knowledge workers: your domain expertise and accumulated skills retain value, but assumptions about workflow continuity—even with minimal AI integration—no longer hold.

A 200-line text file didn't determine winners and losers. It accelerated a transition anticipated to unfold across five years into a 48-hour valuation adjustment. This pattern now propagates through every sector where expertise translates to structured instructions: skills.sh for engineering processes, Anthropic modules for professional services, agent frameworks for operational systems.

Yet remember: markets move faster than organizations. While equity prices adjust in hours, institutional transformation requires years. This mismatch guarantees continued volatility—periodic shocks as individual adoption milestones trigger sector-wide reassessments, followed by partial recoveries as implementation timelines stretch beyond initial expectations. The window for proactive workflow reconstruction—organizational and personal—narrows with each new capability release, but closes gradually, not instantly. Strategic response requires urgency without panic.